open end mortgage example

If you later borrow another 50000 you will begin paying principal and interest on the total amount. Open-End Mortgage Example.

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

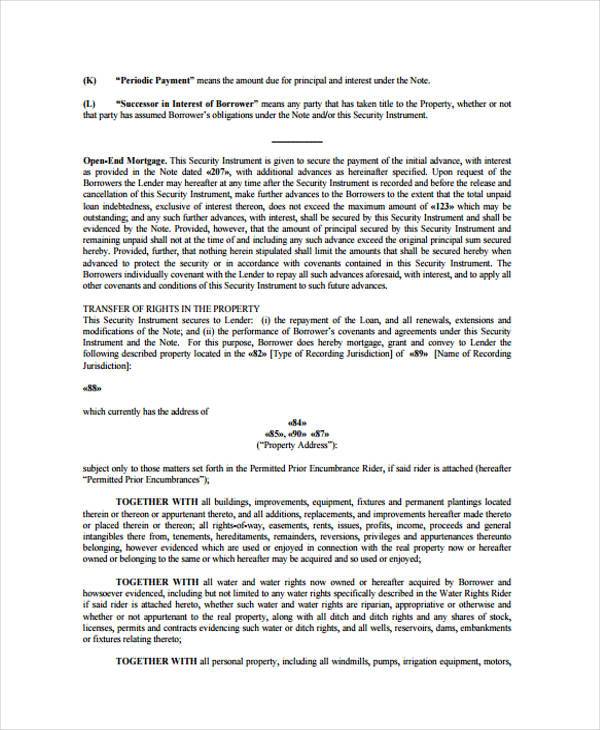

8143 f and shall secure Future Advances and shall have lien priority in accordance with the provisions of 42 PaCS.

. What is an open ended mortgage loan. Instead borrowers use loan funds from time to time as required. As a borrower you can increase the mortgage principals outstanding amount at a later date.

Higher-cost closed-end mortgage loans and ing on whether the credit is open-end credit cards example the finance charge on a loan always. Banks typically establish a maximum loan-to-value ratio. Examples of open-ended loans include lines of credit and credit cards.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. With Future Advance Clause 1.

Broad Street 21st Floor Columbus OH 43215 as mortgagor together with its. There is usually a set dollar limit on the additional amount that can be borrowed. With an open-end mortgage youll still be approved to.

Open-ended mortgages give homeowners the flexibility to use the equity invested in their homes as a source of credit. All notices to be given. An open-end mortgage gives you access to funds from multiple sources and helps you keep track of how much money is going toward which bills.

Open-end mortgage is two hundred percent 200 of the original principal amount of the note plus accrued but unpaid interest fees costs and expenses and advances made as provided herein. This is a drawback of the open-end mortgage. A secured open-end loan on the other hand is a line of credit that requires collateral for approval.

Its a sort of revolving credit in which the borrower can tap into the same loan up to a certain limit. 5 EAST CALL STREET. Of course this is only if he decides to exercise the full amount he was approved to borrow in the initial agreement.

An open-end mortgage often works best when home buyers or investors choose a fixer-upper property that requires serious renovations. An open-end mortgage blends some qualities of a 28. The home you end up purchasing costs 300000 but it needs some work done.

They can borrow against that amount as needed then pay down the balance. THIS OPEN-END MORTGAGE ASSIGNMENT OF LEASES AND RENTS SECURITY AGREEMENT AND FIXTURE FILING this Security Instrument is made as of this 22nd day of August 2012 by DAYTON MALL II LLC a Delaware limited liability company having its principal place of business at 180 E. For example if you have two car payments a student loan and two credit cards an open-end mortgage would allow you to funnel everything into one place instead of juggling multiple payments each month.

The maximum amount available per the terms of the original mortgage agreement is 400000. The mortgage is used to purchase property but through an open-end mortgage the borrower can use it on renovations for that property. An open-ended loan is a loan that does not have a definite end date.

A secured credit card and home equity 8. As a result the total loan both the initial and the top-up will not be allowed to. ParaCrawl Corpus - Anti-fraud data-sharing schemes such as CIFAS and HUNTER which help building societies to prevent fraudulent mortgage advances of approximately GBP 25 million.

Truth in Lending Act compliance handbook. Definition and Examples of an Open-End Mortgage. Open-ended mortgages function like your credit.

For example if you take out a 300000 open-end mortgage and utilize 200000 to purchase a home you only pay interest on 200000. Notwithstanding the foregoing to the maximum extent permitted by law Mortgagor hereby. This type of mortgage makes sense for.

THIS OPEN-END MORTGAGE AND SECURITY AGREEMENT this Mortgage is made as of November 10 2004 by AHT RESIDENCE INN II LIMITED PARTNERSHIP a Virginia limited partnership as Mortgagor Mortgagor whose address is 814 E. This open-end mortgage further secures all advances authorized under 42 pa. This Mortgage shall constitute an Open -End Mortgage as such term is defined in 42 PaCS.

Example of an Open-End Mortgage. This arrangement provides a line of credit rather than a lump-sum loan amount. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

Main Street Richmond Virginia 23219 to WACHOVIA BANK NATIONAL ASSOCIATION a national banking association as. For instance lets say youre approved to take out a 400000 mortgage. An open-end loan for example a credit card is a pre-approved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before payments are due.

An open-end mortgage is a type of home loan where the lender does not provide the entire loan amount at once. An open-end mortgage allows you to borrow additional money on the same loan at a later date. OPEN-END REAL ESTATE MORTGAGE.

Open-end mortgages permit the borrower to go back to the lender and borrow more money. Open-end mortgages are distinct in that they are a loan agreement secured by a real estate property with funds going solely toward. An open-end mortgage saves the borrower the time and trouble of looking for a loan elsewhere.

This home loan type allows you to go back to the lender to borrow additional. OPEN END MORTGAGE A mortgage under which the lender has the option of advancing more funds where for example the value of the property is anticipated to increase. A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender.

IA 50511 515 295-3595. Example of an Open-End Mortgage. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property.

The date of this Mortgage is 12-16-2005 and the parties and. It can only be used for the collateral that is pledged for the mortgage. So the borrower has an additional 50000 available in the future.

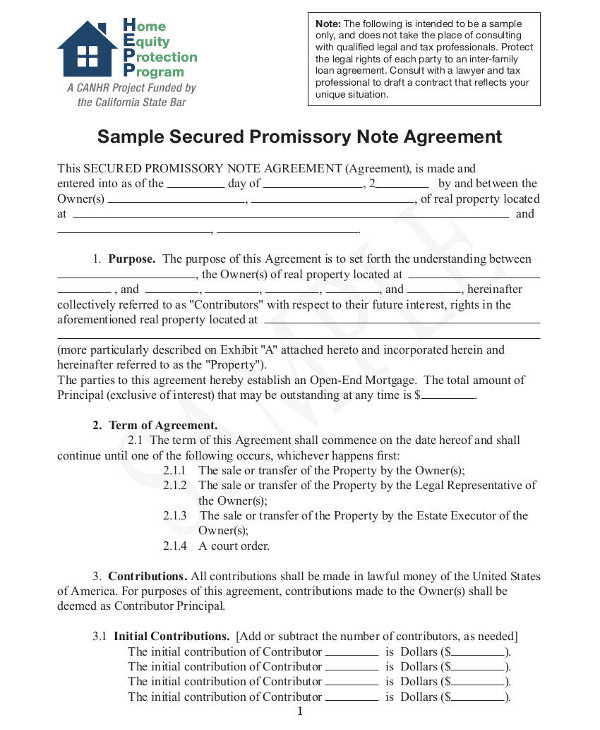

Promissory Note Examples 22 Pdf Word Apple Pages Examples

Understanding Finance Charges For Closed End Credit

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Free 10 Security Agreement Forms In Pdf Ms Word

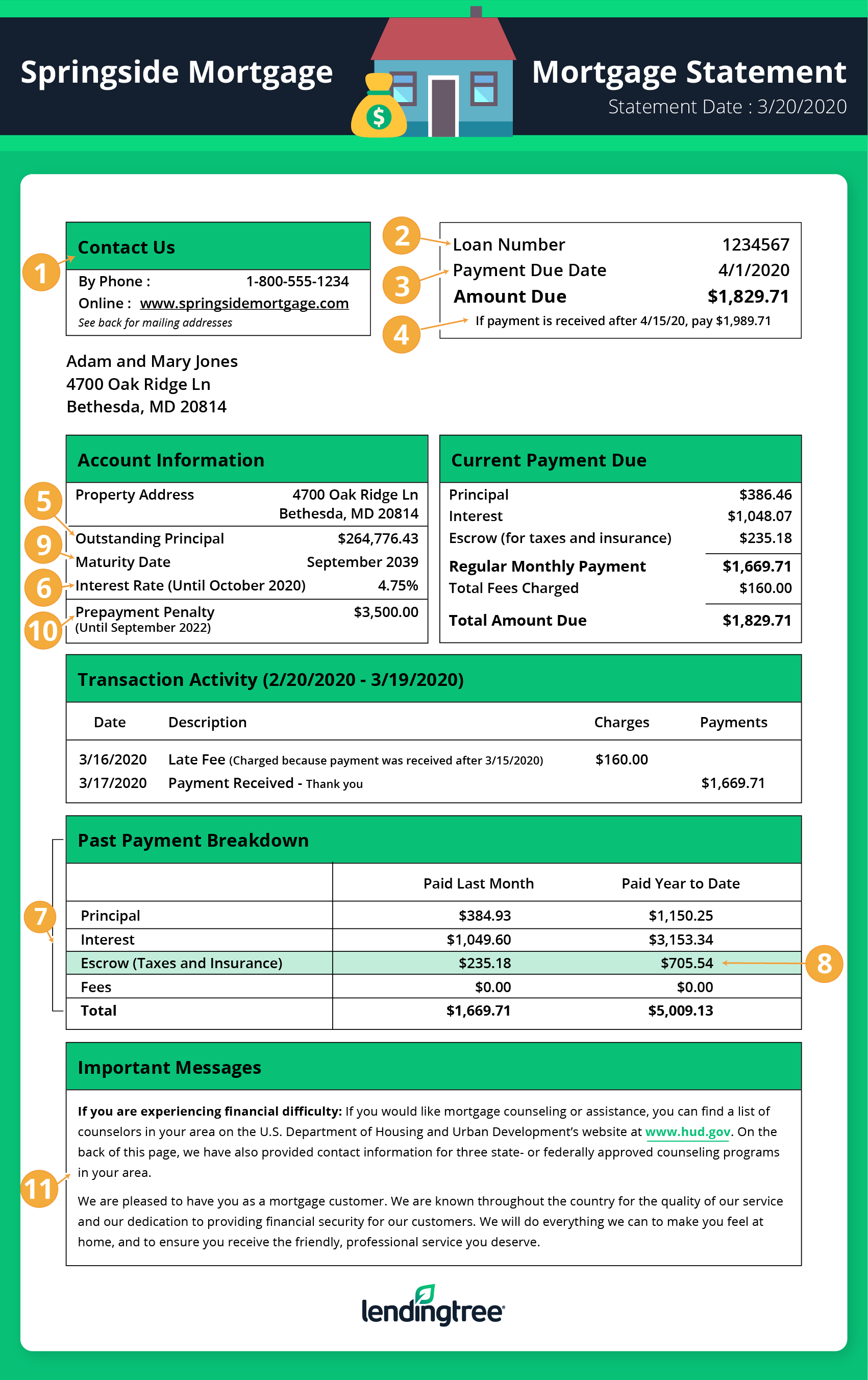

Mortgage Payments Explained Principal Escrow Taxes More

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

What Is Open End Credit Experian

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

![]()

What Types Of Loans Are There Student Loan Hero

What Is An Open End Mortgage Rocket Mortgage

How To Read A Monthly Mortgage Statement Lendingtree

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

:max_bytes(150000):strip_icc()/shutterstock_188743595.home.equity.loan.cropped-5bfc30d1c9e77c0026b5f52e.jpg)

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

:max_bytes(150000):strip_icc()/shutterstock_292433354.reverse.mortgage.cropped-5bfc31484cedfd0026c22351.jpg)